Is the TrendUp Now Program Worth It in 2025? Structure, Benefits, and Career Impact

This article originally appeared in June 2025. We are showcasing it here with the author’s permission.

In 2022 someone published a detailed Medium review of the TrendUp Now Program that became popular among people trying to break into hedge funds and other buy-side roles. I found that article in early 2024 while trying to figure out how to pivot from corporate finance into investment strategy. It was one of the few detailed reviews online and convinced me to apply. A year later, I have completed the program, earned the Certified Futures and Options Analyst (CFOA) credential, and gone through their Specialization and Recruitment Program (SRP). Here is what the program looks like today, what has changed since 2022, and whether I think it is worth it.

Overview

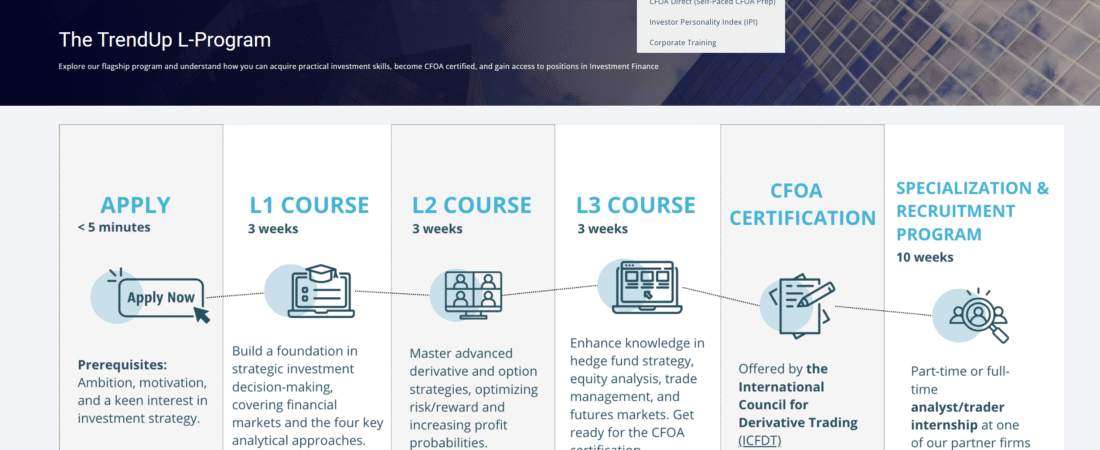

Summary: The TrendUp Now L-program is still structured around three short courses known as L1, L2, and L3. Each lasts three weeks and teaches progressively advanced concepts in equity research, trading, and derivatives. Participants who pass all three levels qualify for the CFOA examination and can compete for the coveted Specialization & Recruitment Program (SRP), which connects top candidates with buy-side internships and career support. For those only interested in the CFOA exam and none of the career development aspects, TrendUp is now also offering CFOA Direct, which is a fully self-paced prep program, but that is not the focus of this review.

Time Commitment: The three L courses together take about nine weeks. The SRP, if you make it, lasts around ten additional weeks. Most of the material is asynchronous, with a few short live sessions each level. This makes it manageable for people who work or study full time. Some people worry about not being able to do well in the program while holding a full-time job and/or being a full-time student, but the reality is that most participants are on that same boat, and the program is expressly designed to accommodate people with other commitments, as that’s how most ambitious people’s lives look like.

Participants: The participant profile is similar to what the 2022 review described: mostly people in their twenties and thirties, heavy on finance and economics backgrounds but not exclusively. There are significantly more international participants now, and slightly more women, though it is still male-dominated.

Pros

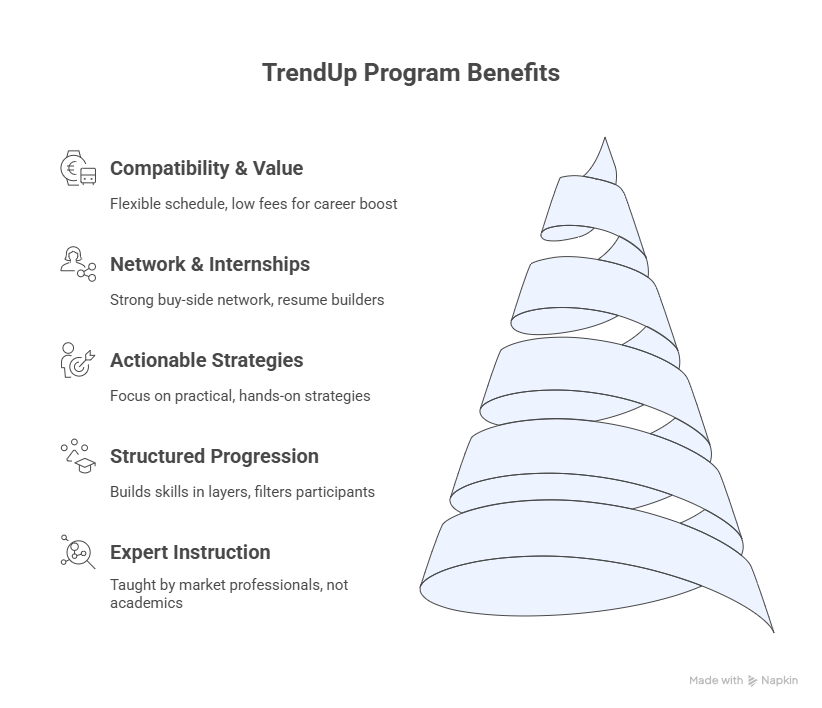

Expert-led instruction: The courses are still taught by professionals who actively work in hedge funds or family offices rather than career coaches or academics. This makes the content highly practical and connected to the realities of the market.

Structured progression: The L1 to L3 structure lets you build skills in layers. You cannot coast through, since each level acts as a filter, but it also means those who finish are genuinely prepared. This structure also keeps you focused and I think is a better approach than a purely on-demand, unselective, training program.

Focus on actionable strategies: The material balances fundamentals, event-driven research, and volatility-based trading, with a heavier emphasis on options and futures than traditional programs. The key differentiator though is that the material is devoid of fluff and is focused on actionable, hands-on strategy.

Network and internships: In my view the SRP remains the strongest part of the offering. TrendUp’s buy-side network is much larger in 2025 than it was in 2021, and the internships are very meaningful resume builders. There is not much out there that can compete with this.

Compatibility with full-time schedules: Deadlines are firm but not excessive, and almost all coursework can be completed on your own time.

Great Value: The fees remain very low, especially if you qualify for the student discounts. But even if you don’t, it’s hard to find such career acceleration at these price levels elsewhere.

Cons

High selectivity: Acceptance into L1 does not guarantee continuation to L3 or SRP. Roughly two-thirds of participants advance at each stage, so it is competitive.

Internship supply still limited: Even with TrendUp’s growth, SRP internships are not unlimited, and people with narrow preferences sometimes wait longer for placement. This also caps the number of SRP participants at around 8-12 participants per cycle, depending on time of the year and internship availability.

Effort required: Success depends on consistent work and engagement. This is not a shortcut into investment jobs. It provides tools and connections, but you must do the rest.

Occasional platform bugs: The learning portal works well overall, but we had minor technical glitches with the L3 trading challenge and the L1 skills assessment. These issues are usually resolved quickly and do not impact the overall experience.

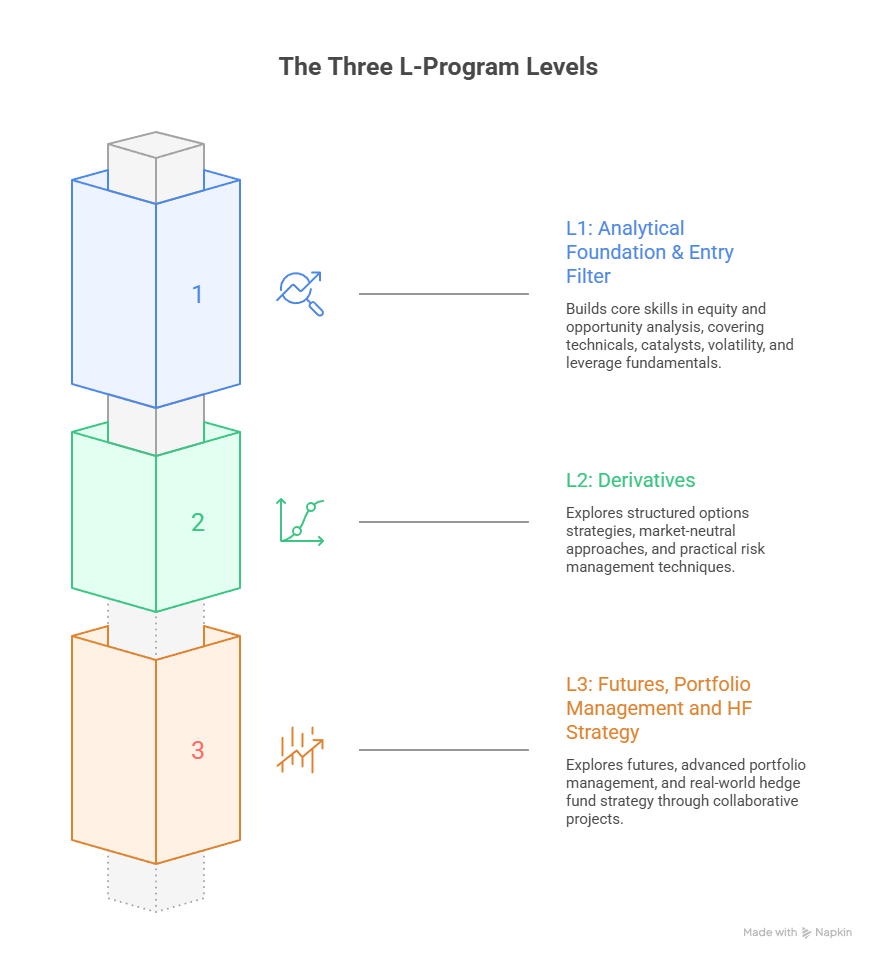

The L1 Course

L1 serves as the initial filter. It focuses on core equity analysis and develops concepts like technical analysis, event-driven catalysts, volatility considerations, and leverage. The material is a mix of pre-recorded lectures, slides, and quizzes. There are also two synchronous elements: an introductory session and a quick stock pitch session where you present one long and one short idea.

A 3rd synchronous and unique feature is the one-on-one session with the instructor, usually a hedge fund manager. In my case, this was invaluable since it allowed me to explain my goals and get candid feedback on my career path. The skills assessment and final exam at the end of L1 are timed and fairly intense, and they determine whether you move forward.

Aside from the L1 exam and Skills Assessment, all the other activities are optional, and nothing happens if you can’t make it to a live session, as they’re always recorded.

Top recommendation: Ace the L1 exam, it’s the most important component for L2 progression. Don’t bomb the Skills Assessment, but it’s not the end of the world

The L2 Course

L2 shifts the focus toward derivatives and trading strategies. The content here was the most eye-opening for me, as it introduced directional and market-neutral strategies built around options. I had done some retail options trading before, but this was my first exposure to structured volatility strategies and proper risk management.

There is another one-on-one session with the instructor in L2, as well as a trading session that demonstrates how to set up and monitor trades. An optional research article component allows you to write and publish a stock idea, which can be a nice resume boost (but I’d recommend you finish the article in L3). The final exam at this level is more challenging than L1 and tests whether you can apply multiple frameworks at once.

I really liked the options trading log activity and the conversation I had about it with my instructor. Like L1 though, only the final assessment component (the L2 final exam in this case), is required. All other activities are optional.

The L3 Course

The final course brings everything together. It adds futures and more advanced trade and portfolio management concepts. The highlight is the Hedge Fund Strategy Workshop, where you team up with other participants to develop and present an in-depth investment thesis and trade plan. This project mimics real buy-side workflows and is one of the best parts of the entire program. This is by far the most important component when it comes to SRP attractiveness, as they will see you working with others to present an investment idea and set up a trade, pitch it to the hedge fund manager, and navigate his questions. If you do well here, chances you get invited to apply to the SRP are high.

Passing the L3 exam makes you eligible for the CFOA and also places you in the pool for SRP selection. Roughly the top twenty percent of each cohort advances to SRP, although waitlisted candidates sometimes get picked up later if spaces open, so not all is lost if you don’t get picked the first time around.

Certified Futures and Options Analyst (CFOA)

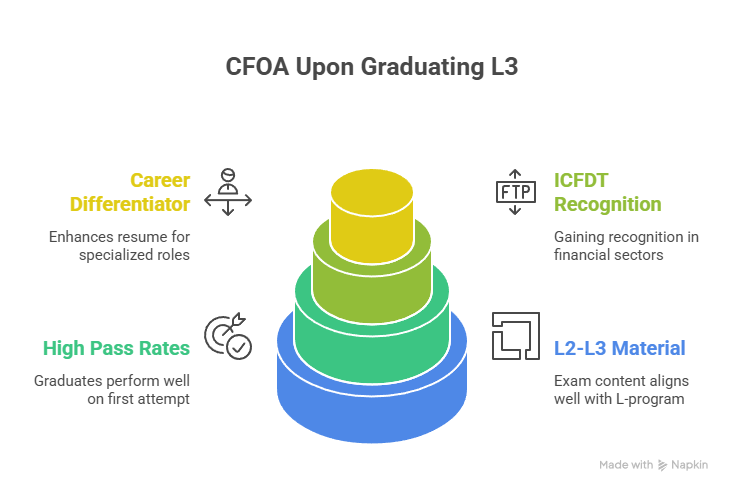

The CFOA examination is typically offered at no extra cost about a month after completing L3. This sponsored version is a one-hour, multiple-choice assessment designed to test applied knowledge of options and futures, with an emphasis on real-world scenarios rather than rote memorization of formulas. Because the exam content aligns closely with the material covered in the L-program, graduates tend to perform well; first-attempt pass rates are high, and most candidates who retake it succeed on their second try.

The credential is administered by the International Council for Derivative Trading (ICFDT), which oversees professional standards in derivatives education. While the CFOA is not as widely known as the CFA charter, it is steadily gaining recognition among hedge funds, proprietary trading firms, and family offices as a credible indicator of derivatives proficiency. For candidates seeking to demonstrate specialized skills in options and futures, particularly those without prior buy-side experience, the CFOA can serve as a meaningful differentiator on a resume or LinkedIn profile.

Specialization and Recruitment Program (SRP)

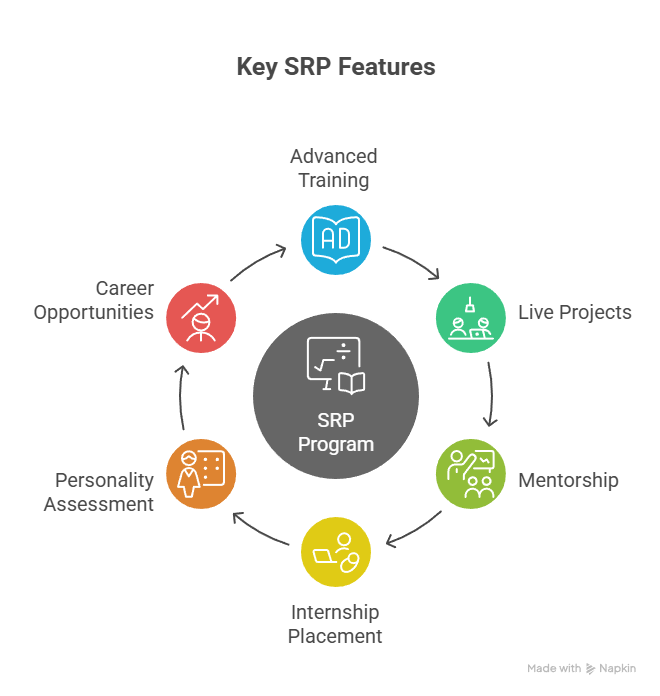

The SRP is the capstone experience for L-program grads. It lasts about ten weeks and combines advanced training, live projects, close mentorship, and direct internship placement with buy-side firms. During my SRP, I worked with a family office on both equity research and trading strategy. There are weekly mentor sessions, recruiting workshops, and specialization modules tailored to different career paths such as analyst or trader. There is also a truly eye-opening personality assessment, the Investor Personality Index (IPI) report, which is also included for all SRP participants, regardless of which firm they intern in.

Internships vary: some are paid, some remote, some in person. The key value is access to roles that are normally impossible to get without connections. Many SRP participants end up with full-time offers after their internships, although that is not guaranteed.

My Outcome

Before joining TrendUp, I was working in corporate finance with limited exposure to real investing. Completing the L courses, earning the CFOA, and participating in the SRP gave me both the skills and the credibility I needed to transition into a hedge fund analyst role. The program did not hand me a job, but it equipped me with the knowledge and network to compete in an exceptionally selective industry.

Around four months after finishing, a recruiter reached out to me on LinkedIn, specifically mentioning my CFOA and hedge fund experience as the key reasons I stood out. That outreach led to an interview and ultimately to an offer for the role.

Bottom Line

TrendUp Now in 2025 is more polished and better connected than it was in 2022. The core strengths are the same: expert-led instruction, structured learning, and access to internships that are otherwise out of reach. It is demanding, and progression is competitive, but for people serious about breaking into the buy-side it remains one of the few programs that genuinely moves the needle.