Latest posts

-

Volmageddon Unveiled: The Anatomy of a Derivatives Market Shock and the Imperative for Education

On February 5, 2018, the financial world witnessed a seismic event colloquially termed “Volmageddon”, a portmanteau of “Volatility” and “Armageddon” that quickly gained traction in trader forums. This day saw the CBOE Volatility Index (VIX) surge over 100% in a single trading session, from 18 at the open to over 37 by market close, triggering…

-

The Next Decade in Finance: Skills and Development Priorities for Investment Professionals

The investment industry is undergoing a period of accelerated change. Shifts in technology, market microstructure, regulation, and client preferences are reshaping the skill sets required to remain competitive. Over the next decade, professional development will need to go beyond maintaining technical competence and instead focus on building adaptive, multidisciplinary capabilities. 1. Data Science and Analytical…

-

Earnings Revisions: The Quiet Indicator Shaping Equity Markets in Q3 2025

While headline price movements dominate market coverage, corporate earnings revisions often provide a more accurate picture of underlying trends. In Q3 2025, the pace and direction of analyst forecast changes are giving early clues about sector leadership, regional resilience, and the balance of risks heading into year-end. Current revision trends Aggregated sell-side data shows the…

-

Understanding the Role of Liquidity in Financial Markets

Liquidity is one of the most fundamental yet misunderstood concepts in finance. At its core, liquidity refers to the ease with which an asset can be bought or sold in the market without significantly affecting its price. While often discussed in the context of individual securities, liquidity operates on multiple levels, from single stocks to…

-

Trading Psychology, Investor Personality, and the Investor Personality Index (IPI)

A discussion of trading psychology, investor personality, and the market-specific assessment behind the IPI

-

How Professional Traders Manage Risk in Volatile Markets

Proven techniques for position sizing, diversification, hedging, and discipline that help traders protect capital and thrive in unpredictable conditions

-

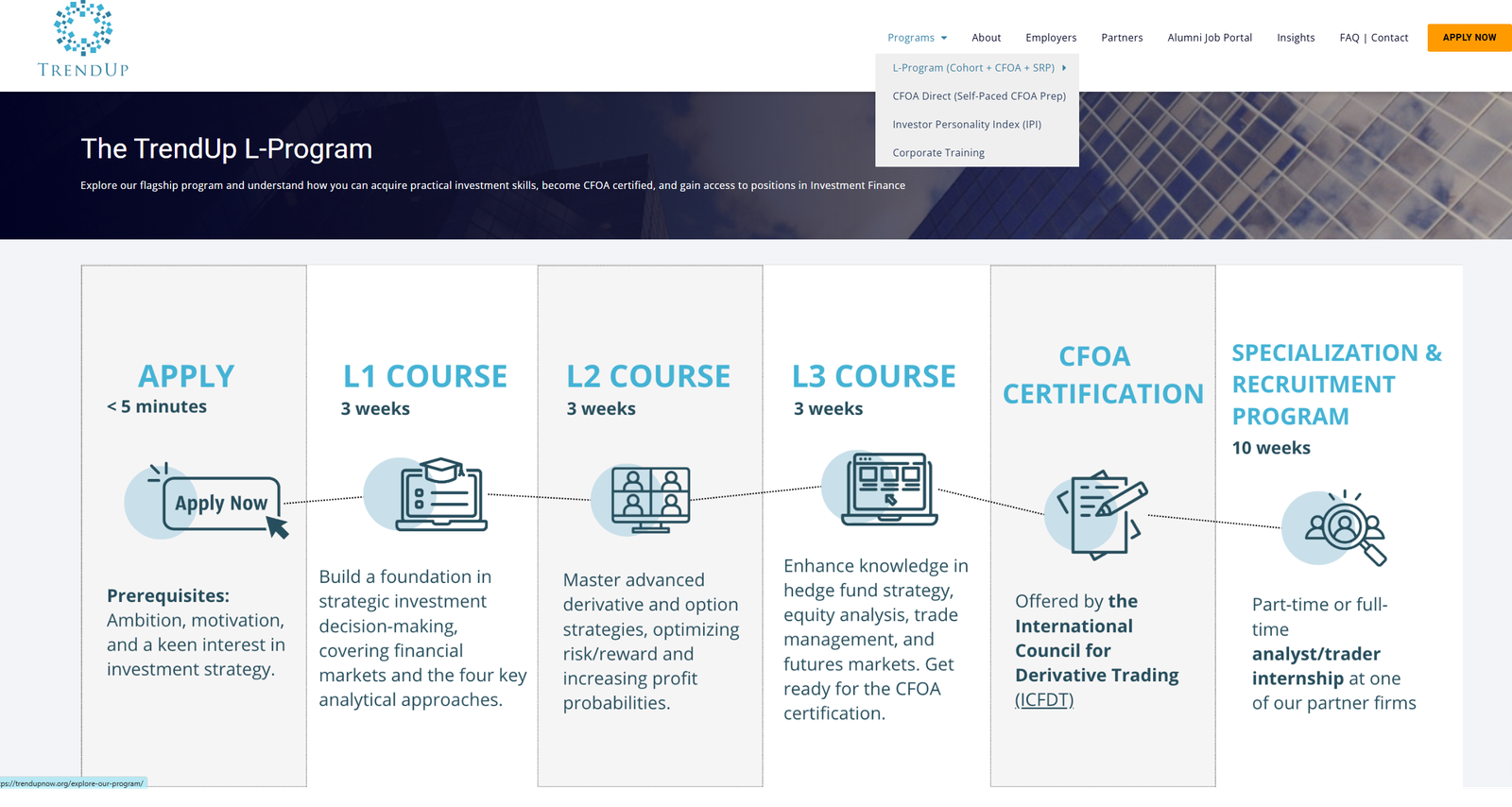

TrendUp Now L-Program: 2025 Review

Is the TrendUp Now Program Worth It in 2025? Structure, Benefits, and Career Impact

-

Hedge Fund vs Private Equity Careers: Which Path Fits You in 2025?

Hedge fund or private equity? Breaking down skills, pay, and recruiting trends

-

Highest Paying Finance Jobs in 2025: Hedge Funds, Private Equity, and Beyond

The true highest paying finance jobs… once you factor in hours worked

-

What is the Certified Futures and Options Analyst (CFOA)?

A Complete Guide to the Only Derivatives-Focused Certification